Wednesday 22 Sep 2021, 09:30

Government-coordinated action needed as fraud losses rise by 30 per cent

UK Finance today releases its latest fraud report covering the first half of 2021. This report shows the scale of fraud taking place as well as demonstrating how criminals have shifted their focus to exploit weaknesses outside the banking system.

Changing nature of fraud

In previous years the largest fraud losses have been unauthorised frauds mainly committed using payment cards.

This year, however, criminals focused their activity on what is termed authorised push payment (APP) fraud. In APP fraud a customer is tricked into authorising a payment to an account controlled by a criminal. In these scams the criminal’s activity takes place outside the banking system.

Using tactics such as scam phone calls, text messages and emails, as well as fake websites and social media posts, criminals seek to trick people into handing over personal details and passwords. This information is then used to target victims and convince them to authorise payments.

As a result, we saw a 71 per cent increase in APP fraud during the first half of 2021 and, for the first time, the amount of money stolen through APP fraud overtook card fraud losses.

We also saw changes in how criminals moved stolen money. They targeted people as young as 14 via social media platforms to become money mules, where their bank account is used to launder stolen money. Intelligence shows a notable increase in the use of cryptocurrency wallets being used to take stolen money outside of the banking system quickly.

Fraud is now at a level where it poses a national security threat – as such, the banking and finance industry is calling for government-coordinated action across all sectors to tackle the issue, including ensuring that all economic crime is brought within the scope of the Online Safety Bill.

Half year 2021 fraud total losses

In total £753.9 million was stolen through fraud, an increase of 30 per cent compared to the same period last year. An overview of the loss figures is included here, with more detailed information in the tables below.

Unauthorised fraud losses were £398.6 million, an increase of 7 per cent. The banking and finance industry prevented a further £736 million of attempted unauthorised fraud which means that £6.49 in every £10 of attempted unauthorised fraud was blocked.

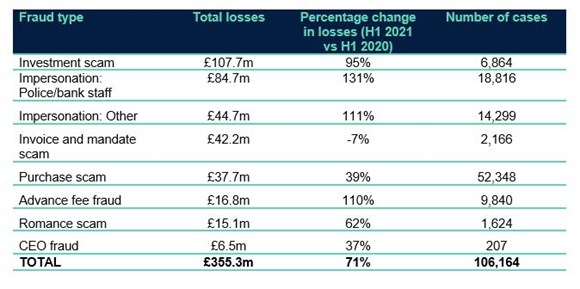

Authorised push payment (APP) fraud losses were £355.3 million, an increase of 71 per cent, including:

- Impersonation scams: as previously announced, losses were £129.3 million (up 123 per cent) as criminals posed as delivery companies, the NHS and government departments by sending out scam texts and emails.

- Investment scams: losses were £107.7 million (up 95%) as people were often enticed by adverts on social media offering high returns on investments.

- Romance scams: losses were £15.1 million (up 62%), linked to the rise in online dating during the pandemic.

- Purchase scams: with online retail growing, purchase scams were the most common form of authorised push payment (APP) fraud, accounting for almost half of all APP cases.

Katy Worobec, Managing Director of Economic Crime at UK Finance, said:

“Our latest figures show the sheer scale of fraud taking place in the UK and highlight clearly the need for coordinated action to address this threat. The banking and finance industry invests billions in advanced systems to try and stop fraud happening in the first place, but criminals are exploiting weaknesses outside of banks’ control to trick customers into making payments directly to them.

“This is why we are calling for coordinated action and increased efforts from government and other sectors to tackle what is now a national security threat.

“We recently announced that major technology companies are donating $1m of advertising to raise awareness of the Take Five to Stop Fraud campaign on their platforms which is an important step in helping to raise awareness among consumers of the threat.

“Criminals continue to target customers with a variety of scams, often via online platforms, and it is only through coordinated action that we will be able to really make progress in addressing the problem.”

Staying safe

UK Finance urges customers to follow the advice of the Take Five to Stop Fraud campaign, and remember that criminals are experts at impersonating people, organisations and the police. They spend hours researching you for their scams, hoping you’ll let your guard down for just a moment. Stop and think. It could protect you and your money.

- Stop: Taking a moment to stop and think before parting with your money or information could keep you safe.

- Challenge: Could it be fake? It’s ok to reject, refuse or ignore any requests. Only criminals will try to rush or panic you.

- Protect: Contact your bank immediately if you think you’ve fallen for a scam and report it to Action Fraud.

Detailed fraud figures

Unauthorised fraud

Authorised fraud

Contact Information

UK Finance Press Office

020 7416 6750

press@ukfinance.org.uk

Notes to editors

UK Finance is the collective voice for the banking and finance industry. Representing 300 firms across the industry, we act to enhance competitiveness, support customers and facilitate innovation.

- The full report is available here.

- The banking and finance industry is tackling fraud by:

- Investing in advanced security systems to protect customers from fraud, including real time transaction analysis and behavioural biometrics on devices. The industry prevented £736.1 million of unauthorised fraud in the first six months of 2021, equivalent to £6.49 in every £10 of attempted unauthorised fraud being stopped without a loss occurring.

- Working with the government and law enforcement to establish clear strategic priorities, improve accountability and coordination through the Economic Crime Strategic Board, jointly chaired by the home secretary and the chancellor. This includes supporting the Economic Crime Plan, to harness the combined capabilities of the public and private sectors to make the UK a leader in the global fight against economic crime. We are also working with the government, law enforcement and regulators to develop a more advanced Fraud Action Plan. This will need to include a focus on prevention and tackling money laundering as well as the law enforcement response.

- Sharing intelligence on emerging threats with law enforcement, government departments and regulators through the National Economic Crime Centre. This drives down serious organised economic crime, protecting the public and safeguarding the prosperity and reputation of the UK as a financial centre.

- Sharing intelligence across the banking and finance industry on emerging threats, data breaches and compromised card details via UK Finance’s Intelligence and Information Unit (I&I Unit). In 2020, 2.1 million compromised card numbers were received through our law enforcement strategic partners, and disseminated via the I&I unit to enable card issuers to take the necessary precautions to protect customers.

- Investing in technology such as Mules Insights Tactical Solution (MITS), a technology that helps to track suspicious payments and identify money mule accounts, and Confirmation of Payee, an account name checking service that helps to prevent authorised push payment scams, used when a payment is being made.

- Introducing the APP scams voluntary code, which helps to improve protections, including adding scam warnings during the payment process.

- Delivering customer education campaigns to help prevent consumers being duped by criminals, including through the Take Five to Stop Fraud and Don’t Be Fooled 33major banks and building societies have signed up to the Take Five Charter, bringing the industry together to give people simple and consistent fraud awareness advice.

- Training staff to spot and stop suspicious transactions. The Banking Protocol scheme allows bank staff to alert the police when they think a customer is being scammed, whether in branch, on the telephone, or online banking. The Banking Protocol has prevented £174 million in fraud and led to 934 arrests since launching in 2016.

- Sponsoring a specialist police unit, the Dedicated Card and Payment Crime Unit, which tackles the organised criminal groups responsible for financial fraud and scams. In the first half of 2021 the Unit prevented an estimated £85 million of fraud, arrested 67 fraudsters, and secured 49

- Working with the regulator Ofcom to crack down on number spoofing, including the development of a ‘do not originate’ list. Ofcom has said this work has led to significant successes in preventing criminals from spoofing the phone numbers of trusted organisations.

- Working with text message providers and law enforcement to block scam text messages including those exploiting the Covid-19 crisis. 1087 unauthorised sender IDs are currently being blocked to prevent them being used to send scam text messages mimicking trusted organisations, including over 70 related to Covid-19.

About Us

For more information please call the UK Finance press office on 020 7416 6750 or email press@ukfinance.org.uk

Representing 300 firms, we’re a centre of trust, expertise and collaboration at the heart of financial services. Championing a thriving sector and building a better society.